Freight protection policies (cargo insurance) are essential for fleet owners to safeguard their goods and ensure operational continuity. Cargo insurance fleet owners should consider the type of freight, fleet size, and unique operational risks when selecting policies. Affordable cargo insurance options cater to both small fleet freight insurance needs and multi-truck cargo plans for larger operations, offering trucking cargo liability and cargo damage protection. By evaluating specific requirements, businesses can find tailored freight protection policies, protecting their assets while keeping premiums under control, thus fostering financial stability and a competitive edge in the market.

“As a fleet owner, ensuring your cargo is protected during transit is paramount. This comprehensive guide delves into the world of freight protection policies, offering insights to help you navigate the process efficiently. We explore key factors to consider when choosing cargo insurance for your fleet, from understanding liability and damage protection to discovering affordable options tailored for small and multi-truck fleets. By the end, you’ll be equipped to select the perfect coverage.”

Understanding Freight Protection Policies: A Comprehensive Guide for Fleet Owners

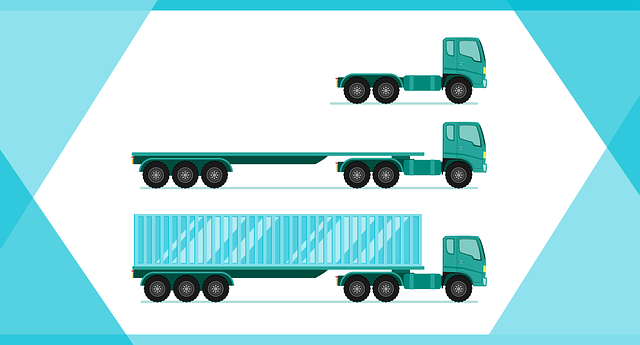

Freight Protection Policies are an essential tool for fleet owners to safeguard their valuable cargo and maintain operational efficiency. These policies, also known as cargo insurance, offer comprehensive coverage for various risks associated with transporting goods, including physical damage, theft, and liability claims. Understanding the intricacies of freight protection is crucial for fleet managers to make informed decisions when selecting suitable insurance plans.

For small fleet owners, accessing affordable cargo insurance that aligns with their unique requirements can be a challenge. However, many insurance providers offer tailored multi-truck cargo plans designed to cater to different trucking operations. By evaluating their specific needs, including the type of cargo transported, vehicle utilization, and risk exposure, fleet owners can choose policies that provide the necessary protection without exceeding budget constraints. This proactive approach ensures that should an incident occur, the fleet’s financial stability is preserved, allowing them to continue operations seamlessly.

Key Factors to Consider When Choosing Cargo Insurance for Your Fleet

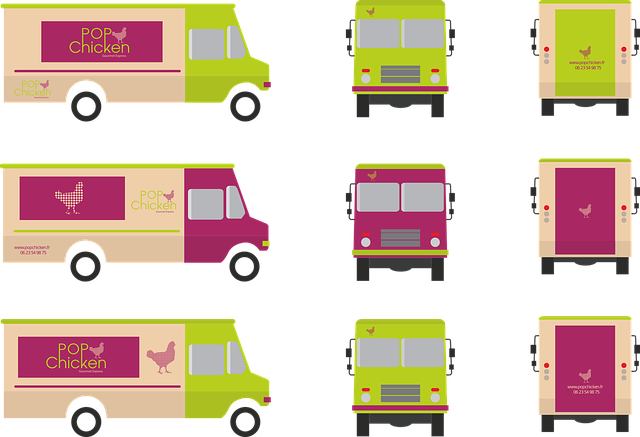

When selecting cargo insurance for your fleet, several key factors demand careful consideration. Firstly, evaluate the specific type of freight your trucks carry, as different goods necessitate varied levels of protection. Hazardous materials, perishable items, and high-value cargo each require tailored coverage to ensure comprehensive freight protection policies.

Next, assess the size and operations of your fleet. Small fleet freight insurance options cater to smaller operators with limited vehicles, often offering affordable cargo insurance that fits budget constraints. Conversely, multi-truck cargo plans scale up for larger fleets, providing extensive trucking cargo liability and customized cargo damage protection. Fleet owners should weigh these options based on their operational needs and financial resources to procure the most suitable tailored cargo insurance.

Customizing Your Coverage: Tailored Solutions for Small and Multi-Truck Fleets

When it comes to insuring your freight, one size doesn’t fit all. Customized coverage is key for both small fleet owners and multi-truck operations. Cargo insurance fleet owners should look for policies that align with their specific needs. For instance, a small fleet freight insurance plan might prioritize comprehensive cargo damage protection against perils like weather and accidents, while a multi-truck cargo plan could offer tailored solutions for trucking cargo liability, including coverage for cargo loss or damage during transit.

Affordable cargo insurance options are available for all types of fleets. Fleet owners should consider their unique risks and operational requirements when selecting freight protection policies. By choosing the right combination of coverages, fleet owners can ensure their valuable cargo is protected while keeping costs manageable. This personalized approach to insurance allows businesses to thrive without the burden of excessive premiums.

Mitigating Risks: Trucking Cargo Liability, Damage Protection, and Affordable Options

When it comes to managing a trucking business, one of the most essential considerations is mitigating risks associated with freight. Cargo insurance fleet owners should prioritize comprehensive freight protection policies that encompass trucking cargo liability and cargo damage protection. These measures safeguard against potential losses due to accidents, theft, or natural disasters, ensuring both the safety of goods and the financial stability of fleet owners.

For small fleet freight insurance or multi-truck cargo plans, there are numerous affordable options available that cater to diverse needs. Fleet owners can tailor their fleet cargo coverage by selecting policies that offer specific levels of protection based on the type and value of their cargo. By doing so, they can minimize financial risks while optimizing their operations, ensuring a competitive edge in the market.

When it comes to selecting the right policies for your freight requirements, understanding your options and prioritizing key factors is essential. By evaluating your specific needs, considering various coverage types, and exploring tailored solutions, fleet owners can navigate the complexities of cargo insurance effectively. Remember that affordable yet comprehensive freight protection policies are available, catering to both small fleets and multi-truck operations. Mitigating risks through liability coverage and damage protection will ensure a secure and sustainable trucking business.